Sekuritas terkait asuransi, atau ILS, pada dasarnya adalah instrumen keuangan yang dijual kepada investor dan nilainya dipengaruhi oleh peristiwa kerugian yang diasuransikan. Term insurance-linked security (ILS) mencakup kelas aset ILS, yang terdiri dari obligasi katastropik, instrumen reasuransi yang diagunkan, dan bentuk sekuritisasi terkait risiko lainnya.

What are insurance-linked securities (or ILS)?

Insurance linked securities, or ILS, are essentially financial instruments which are sold to investors and whose value is affected by an insured loss event. The term insurance-linked security (ILS) encompasses the ILS asset class, which consists of catastrophe bonds, collateralized reinsurance instruments and other forms of risk-linked securitization.

Insurance-linked securities (ILS) are investment assets generally thought to have little to no correlation with the wider financial markets as their value is linked to insurance-related, non-financial risks such as natural disasters, other insurable specialty risks and life and health insurance risks including mortality or longevity.

As securities, some insurance-linked securities (mainly catastrophe bonds) can be and are traded among investors and on the secondary-market.

They allow insurance and reinsurance carriers to transfer risk to the capital markets and raise capital or capacity. They also allow life insurers to release the value in their policies by packaging them up and issuing them as asset-backed notes.

The market for insurance-linked securities (ILS) emerged in the mid-1990’s as a mechanism for insurance and reinsurance companies to access the deepest and most liquid pool of capital available, the global capital markets.

Now an established alternative asset class, insurance-linked securities (ILS) are typically invested in by large institutional investors such as pension funds, sovereign wealth funds, multi-asset investment firms and funds, endowments, as well as some family office investors.

As well as forming part of the spectrum of pure reinsurance risk transfer tools available to the global insurance market, insurance-linked securities (ILS) are also used by some large corporates to access insurance capacity from the capital markets, as well as by governments to secure disaster risk financing.

Read our what is a catastrophe bond? article to gain a better understanding of that area of the insurance-linked securities market.

Read about recent and historic catastrophe bond transactions in our Deal Directory, which contains information on more than 700 issuances.

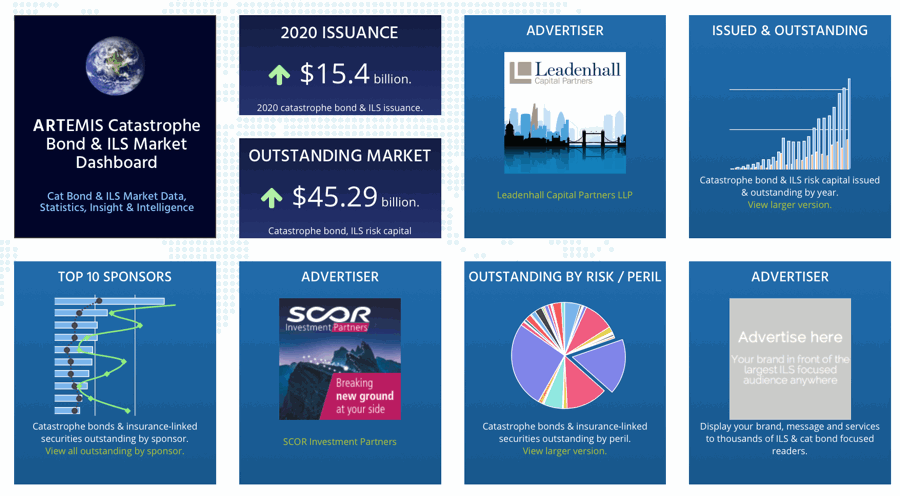

Analyze the catastrophe bond market using our Dashboard and range of ILS charts and statistics.

Analyze the catastrophe bond market using our Dashboard and range of ILS charts and statistics.

Our charts allow you to analyze and visualize issuance in the cat bond and related ILS market, breaking it down by type of transaction, the catastrophe and insurance perils covered, the range of triggers used, who the largest sponsors of cat bonds are, as well as the pricing dynamics in the ILS market.